Has Cost Of Living Changed In The Last 70 Years

On the confront of it, these should be heady times for American workers. U.Southward. unemployment is as low equally it's been in almost two decades (3.nine% equally of July) and the nation'south private-sector employers take been adding jobs for 101 directly months – 19.5 million since the Neat Recession-related cuts finally abated in early 2010, and 1.5 million just since the beginning of the year.

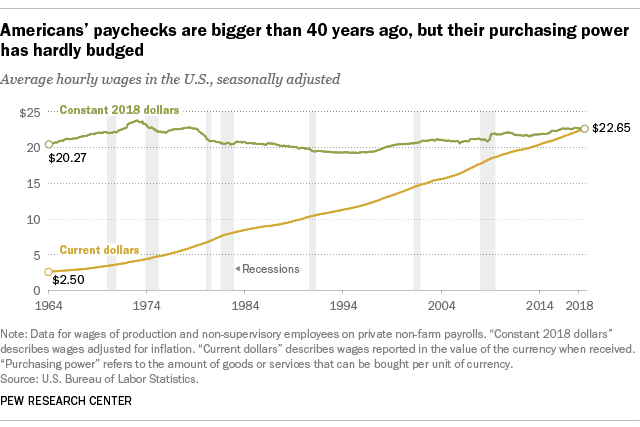

Only despite the potent labor market, wage growth has lagged economists' expectations. In fact, despite some ups and downs over the past several decades, today's real average wage (that is, the wage after accounting for aggrandizement) has near the aforementioned purchasing power it did 40 years agone. And what wage gains there have been have more often than not flowed to the highest-paid tier of workers.

The disconnect between the task market and workers' paychecks has fueled much of the recent activism in states and cities around raising minimum wages, and it too has become a factor in at to the lowest degree some of this year's congressional campaigns.

The disconnect between the task market and workers' paychecks has fueled much of the recent activism in states and cities around raising minimum wages, and it too has become a factor in at to the lowest degree some of this year's congressional campaigns.

Average hourly earnings for non-management private-sector workers in July were $22.65, up 3 cents from June and 2.7% above the average wage from a year earlier, according to information from the federal Agency of Labor Statistics. That's in line with average wage growth over the past five years: Twelvemonth-over-year growth has mostly ranged between two% and iii% since the beginning of 2013. But in the years just before the 2007-08 financial collapse, average hourly earnings oftentimes increased by effectually 4% year-over-yr. And during the high-inflation years of the 1970s and early 1980s, average wages commonly jumped 7%, eight% or even nine% year-over-year.

Later adjusting for aggrandizement, however, today'southward average hourly wage has simply near the same purchasing ability it did in 1978, following a long slide in the 1980s and early on 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $four.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.

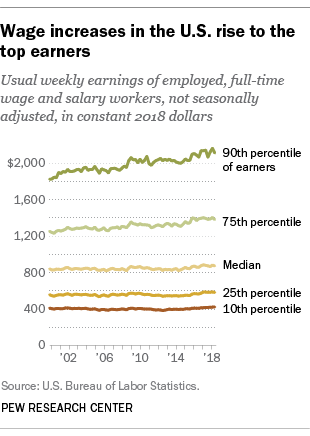

A similar measure – the "usual weekly earnings" of employed, total-time wage and salary workers – tells much the aforementioned story, admitting over a shorter time period. In seasonally adjusted current dollars, median usual weekly earnings rose from $232 in the first quarter of 1979 (when the information series began) to $879 in the second quarter of this twelvemonth, which might sound similar a lot. But in real, aggrandizement-adjusted terms, the median has barely budged over that period: That $232 in 1979 had the same purchasing power equally $840 in today'due south dollars.

Meanwhile, wage gains have gone largely to the highest earners. Since 2000, usual weekly wages have risen three% (in real terms) amid workers in the everyman tenth of the earnings distribution and 4.3% among the lowest quarter. Just amidst people in the top tenth of the distribution, existent wages have risen a cumulative fifteen.seven%, to $2,112 a week – nearly five times the usual weekly earnings of the bottom tenth ($426).

Meanwhile, wage gains have gone largely to the highest earners. Since 2000, usual weekly wages have risen three% (in real terms) amid workers in the everyman tenth of the earnings distribution and 4.3% among the lowest quarter. Just amidst people in the top tenth of the distribution, existent wages have risen a cumulative fifteen.seven%, to $2,112 a week – nearly five times the usual weekly earnings of the bottom tenth ($426).

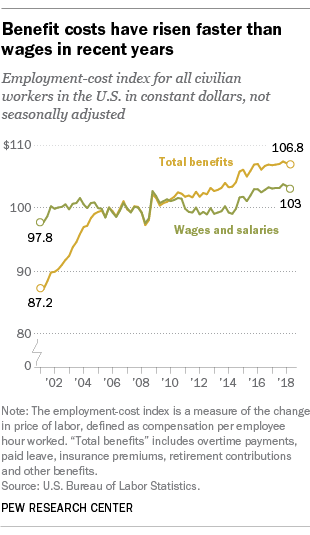

Cash coin isn't the but way workers are compensated, of course – wellness insurance, retirement-business relationship contributions, tuition reimbursement, transit subsidies and other benefits all tin exist part of the package. But wages and salaries are the biggest (about 70%, according to the Bureau of Labor Statistics) and well-nigh visible component of employee compensation.

Wage stagnation has been a subject area of much economic assay and commentary, though possibly predictably there'due south niggling agreement about what's causing it (or, indeed, whether the BLS data adequately capture what's going on). One theory is that ascension benefit costs – specially employer-provided health insurance – may be constraining employers' power or willingness to raise cash wages. According to BLS-generated bounty cost indices, total benefit costs for all civilian workers take risen an inflation-adjusted 22.5% since 2001 (when the data series began), versus 5.3% for wage and salary costs.

Wage stagnation has been a subject area of much economic assay and commentary, though possibly predictably there'due south niggling agreement about what's causing it (or, indeed, whether the BLS data adequately capture what's going on). One theory is that ascension benefit costs – specially employer-provided health insurance – may be constraining employers' power or willingness to raise cash wages. According to BLS-generated bounty cost indices, total benefit costs for all civilian workers take risen an inflation-adjusted 22.5% since 2001 (when the data series began), versus 5.3% for wage and salary costs.

Other factors that have been suggested include the continuing refuse of labor unions; lagging educational attainment relative to other countries; noncompete clauses and other restrictions on job-switching; a large pool of potential workers who are outside the formally divers labor strength, neither employed nor seeking work; and broad employment declines in manufacturing and production sectors and a consequent shift toward job growth in low-wage industries.

Sluggish and uneven wage growth has been cited as a key factor backside widening income inequality in the The states. A contempo Pew Research Center report, based on an analysis of household income information from the Census Bureau, found that in 2016 Americans in the summit tenth of the income distribution earned 8.7 times as much as Americans in the bottom tenth ($109,578 versus $12,523). In 1970, when the analysis flow began, the top tenth earned 6.nine times as much as the lesser tenth ($63,512 versus $nine,212).

Note: This is an update to a post originally published Oct. 9, 2014.

Source: https://www.pewresearch.org/fact-tank/2018/08/07/for-most-us-workers-real-wages-have-barely-budged-for-decades/

Posted by: medranosookinium.blogspot.com

0 Response to "Has Cost Of Living Changed In The Last 70 Years"

Post a Comment